Five Ways to Avoid Repayment Scams and Enroll in the Best Student Loan Repayment Plan for You

By Brenda Calderon, Policy Analyst, Education Policy Project, NCLR

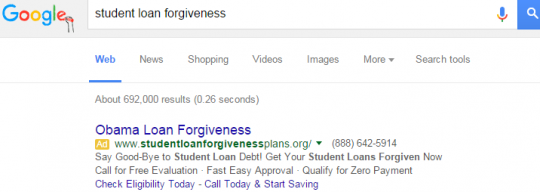

If you graduated with the class of 2015, you may be coming to the end of your six-month student loan “grace period.” While choosing the repayment plan that’s best for you is itself tricky, the process is complicated by websites that are riddled with student loan scams. Recently, the Department of Education released a blog to advise students against loan repayment scams. A cursory search on Google or even Facebook placement ads shows an abundance of companies promising to help students have their debt forgiven and payments substantially lowered.

These companies usually will offer to assist students in filing forms and keep them up-to-date with new laws that forgive loans for a service fee (sometimes monthly). What these companies don’t advertise is that these services are free if a student does his or her own research. Here are some tips to avoid paying for services that are free and manage the repayment process for federal loans:

These companies usually will offer to assist students in filing forms and keep them up-to-date with new laws that forgive loans for a service fee (sometimes monthly). What these companies don’t advertise is that these services are free if a student does his or her own research. Here are some tips to avoid paying for services that are free and manage the repayment process for federal loans:

Keep up with the latest from UnidosUS

Sign up for the weekly UnidosUS Action Network newsletter delivered every Thursday.

- Find out the types of loans you have and whether consolidating your loans is a better option for you. You can look up your federal loans here. It may make sense to consolidate your loans so that you only make one payment each month. If the interest rates don’t vary widely among your loans, this may be an easy way to simplify your monthly repayments.

- Get an estimate of how much your payments will be using the online repayment calculator. This site is funded by the Department of Education and can populate information based on your current loans and their corresponding interest rates to estimate how much you will have to pay each month.

- Get to know your student loan servicer. Your student loan servicer handles your loan after you’ve received the funds. They can help with loan consolidation and repayment options. You can look up your loan servicer here.

- Select a plan that best fits with your current financial situation and goals. There are several variables you will need to consider when choosing the best repayment plan: how much money you are making, how quickly you want to pay off your loan, whether you work for a nonprofit or the government and qualify for loan forgiveness, etc. Vox offers an interactive tool to help you answer these questions and offers repayment options aligned to your responses.

- Use forbearance and deferments only if you absolutely cannot pay your loans. If you are unemployed or cannot afford to pay at least 10% of your discretionary income for loans, this may be an option for you. Having a loan in deferment or forbearance does not reduce the payments—in fact, this may increase the amount you have to pay in the long run.

Choosing the right repayment plan is a difficult decision, but the Department of Education offers tools to help students. With a little research, you can be on your way to saving money by enrolling yourself in the best repayment plan for you!