Will You Be Impacted by the IRS’s Second Round of ITIN Renewals?

By Yuqi Wang, Policy Analyst, UnidosUS

It may feel like tax season just ended, but the IRS is already thinking ahead to next year’s tax filing deadline. The agency recently announced their second round of Individual Tax Identification Number (ITIN) renewals, and we urge all affected taxpayers to renew their ITIN without delay.

Keep up with the latest from UnidosUS

Sign up for the weekly UnidosUS Action Network newsletter delivered every Thursday.

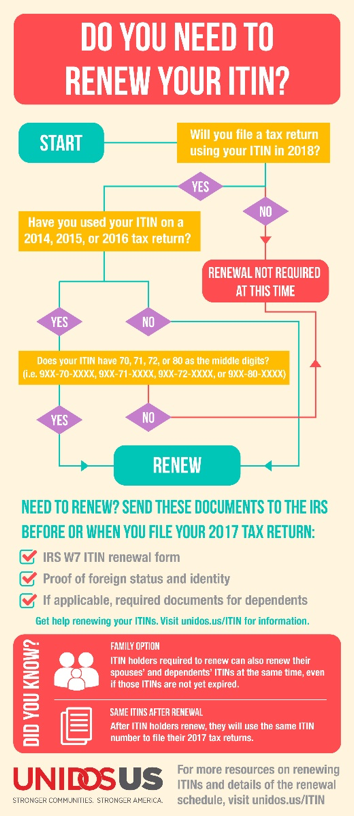

Like the renewal process last year, the taxpayers who will need to renew their ITINs are individuals who have not used their ITIN on a tax return in the last three years, and those who have specific middle digits in their ITINs that the IRS is looking for.

Specifically, taxpayers who will need to renew their ITIN before it expires on December 31, 2017 are individuals who:

Specifically, taxpayers who will need to renew their ITIN before it expires on December 31, 2017 are individuals who:

- Did not use their ITIN to file a tax return for Tax Year 2014, Tax Year 2015, or Tax Year 2016 (i.e. you didn’t file a tax return in 2015, 2016, or 2017).

- Have an ITIN with the middle digits of 70, 71, 72, or 80 (i.e. 9XX-70-XXXX).

If a taxpayer files a tax return with an expired ITIN or renews their ITIN at the same time as they are filing their taxes, then the IRS will not process the taxpayer’s tax return until their ITIN has been renewed. This means the taxpayer could face serious delays in getting tax credits like the Child Tax Credit. These credits are vital to helping many working families make ends meet. It is imperative that affected taxpayers who plan on claiming tax credits, and who will file a tax return next year, renew as soon as possible.

The average wait time for a taxpayer to receive notice that their ITIN has been renewed is seven weeks after they mail their renewal application to the IRS, but this time could increase up to nine weeks during peak tax season (January to April 2018). For many working- and middle-class Latino families, that is too long to wait.

To renew, a taxpayer must complete Form W-7, making sure to check the “Renew an Existing ITIN” box located at the top right corner of the document. Once completed, the taxpayer will need to send the form along with the appropriate identification documents to the IRS at:

Internal Revenue Service ITIN Operation

P. O. Box 149342

Austin, TX 78714-9342

Local Volunteer Income Tax Assistance (VITA) sites are available to help taxpayers answer questions and address concerns, fill out their Form W-7, and to help certify taxpayers’ identification documents so individuals can send copies of their identification documents to the IRS and not original documents.

The IRS has also made the family option available again to affected ITIN holders this year. Any taxpayer who has an ITIN number with middle digits of 70, 71, 72, or 80 and is renewing their ITIN can also renew the ITINs of their spouses and dependents at the same time, even if the spouses’ and dependents’ ITINs have not expired yet. The IRS will accept a renewal application (i.e. Form W-7 and appropriate identification documents) for each member of a family who wants to renew their ITIN under the family option.

For more information about renewing an ITIN, visit the IRS website.