How the CTC is helping these mothers keep a roof over their children’s heads

The evidence is clear: the Child Tax Credit lifts children out of poverty and is “a tool for increasing family social mobility in the long term,” helping families with routine expenses like rent and mortgage payments, essential items, healthy foods, activities for their children, and more.

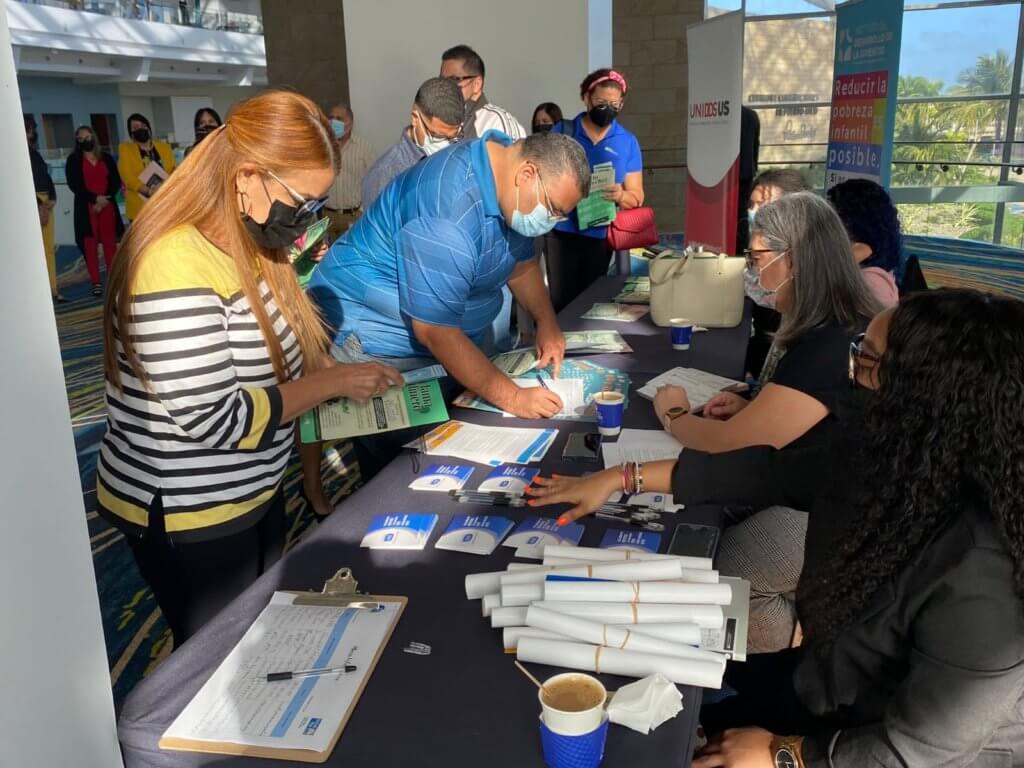

By Beatriz Paniego-Béjar, Affiliate Communication Specialist, UnidosUS

The pandemic has changed child poverty for the worse: 1.2 million more children lived in poverty in 2020 compared to 2019, totaling that number to 12.5 million children. These poverty trends have particularly affected Latino and Black children and households headed by females.

Keep up with the latest from UnidosUS

Sign up for the weekly UnidosUS Action Network newsletter delivered every Thursday.

The Child Tax Credit (CTC) is responding to this problem, and research shows that thanks to the CTC, child poverty would be cut by 45 percent, positively impacting Black and Latino children.

UnidosUS is gathering stories of our families benefiting from the CTC with the help of our Affiliate Network, learning how the credit is alleviating low- and middle-income families’ tight budgets to better provide for their children.

A HELPFUL EXTRA

Yenny Mejia is a mother of two children who works as a janitor in the Los Angeles area (California) and is a participant at our Affiliate Building Skills Partnership. She earns approximately $23,500 a year, and the CTC has been key for her, since she’s been able to pay for her routine expenses: “The credit has helped me a lot to pay for rent,” she shares. For Yenny, the Child Tax Credit has been a helpful extra for her budget, allowing her to stay in her job because her needs are covered.

A WAY TO PAY DOWN DEBT

Elizabeth Rodriguez is a mother of three (one and a half, five-, and six-year-olds) who before the pandemic earned approximately $30,000 with her two jobs. She lost those jobs during the COVID-19 pandemic, and she’s now trying to find a job that will allow her to work while her kids are in school, which is proving to be a challenge lacking childcare. The CTC has been a relief for Elizabeth, allowing her to pay rent and pay down debt, and take good care of her three young children.

A BLESSING

Josefina from Montebello, CA, has a child with Down Syndrome, and she had to stop working to take care of her: “She depends one hundred percent on me,” Josefina shares about her daughter. Our Affiliate Eastmont Community Center helped Josefina file her taxes and she was able to receive the CTC. “We have limited resources, and the credit is a blessing,” she says. “We use it to pay rent, utilities and other home expenses.”

Families can still access the Child Tax Credit. Even as the April 18 deadline has passed, if taxes are not owed, people can still file their taxes and claim the credit. Find more information here, y aquí en español.